Archive for June, 2011

Archive for June, 2011

RVBD at Key Resistance

June 30, 2011 at 9:32 am

Trading ranges or channels tend to stay in effect until, well, they’re no longer in effect. One name right now caught between support and resistance is RVBD.

This computer hardware maker rallied huge from last summer into the first part of 2011, and has since then been basing in a high channel. Rallies to resistance have predominantly been sold, while pullbacks to support have consistently been bought during this time. That’s the routine for a channeling stock.

With the stock currently at the top end of this range, you have to wonder if this is an opportunity for a downside reversal (particularly with the broad market short-term overbought), or perhaps a breakout failure and a subsequent pullback into the lower end of the range. No predictions, just an observation.

Here’s a look at RVBD, showing the trading range it has spent essentially 6 of the past 7 months inside of, with the only time outside the range between mid-Feb to mid-March:

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

FCX On the Move

June 28, 2011 at 1:05 pm

Copper is an important market tell for many, so it’s certainly worth noting that the copper poster child FCX is getting going here as it threatens $50. The stock has repeatedly found support in the $46’s in recent months, and in recent weeks has pulled back quietly beneath a descending trend line.

Today, that trend line is getting crossed, indicating this stock may be ready to leave this congestion pattern behind. There’s room to climb higher, not only for this stock, but potentially for the broader market. We have yet to know if the market pullback has ended, but if copper proves a leading indicator, this could be a bullish sign to pay attention to.

Here’s a look at FCX, showing both lateral support around $46 as well as today’s attempt to push beyond the descending trend line:

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Obscurity and Opportunity

June 28, 2011 at 8:57 am

Prolonged market rallies have a way of pulling obscure stocks off the sidelines and getting them involved in the action. It’s the effect of “a rising tide lifts all boats.”

And that’s entirely fine. It’s nice when new names are added to the mix of active stocks.

The market turned higher in March 2009, and since then we’ve seen considerable progress. Tons of little names have entered the fray, paying astute traders along the way (unintentional rhyme).

While I do have some restrictions on what I will and will not trade, I don’t mind trading some of the more obscure names when they’re set up for moves – so long as they exhibit the proper traits:

Size Matters

Dirt-cheap, thin stocks are not worth trading. They carry much greater potential for pain than profit, despite their inexpensive price tags. But growing stocks (price & volume growth, not necessarily earnings growth) are another story. Every big run starts somewhere, right?

Dirt-cheap, thin stocks are not worth trading. They carry much greater potential for pain than profit, despite their inexpensive price tags. But growing stocks (price & volume growth, not necessarily earnings growth) are another story. Every big run starts somewhere, right?

There’s often a relationship between ‘unknown’ and ‘underowned’ and that can spell exceptional opportunity. Under-the-radar stocks often times begin to exhibit technical characteristics worth noting, raising interest in them in such a way that they’re the up-and-coming stocks. Naturally, they’re little-known, and that means they’re underowned by institutions (the ones who really move stocks). As they exhibit some staying power, interest in them grows. That brings both price and volume up to tradeable levels, placing them squarely on the watch lists of traders like you and me.

(I’m talking to mostly guys here, so ladies please bear with me on this next analogy. I want these guys to “get it” so they know what I’m talking about.)

Think of that co-ed in college who returned from summer looking far better than the previous semester. What happened? Suddenly she has the attention of many more guys, has more dates, and as competition for her time expands, so does her confidence. Now that she’s being noticed, she’s unlikely to regain the 15 she lost and return to the sweats-with-no-makeup look again. (Nothing against the natural, casual look… just stating that a change is likely to last in this case). She’ll quite likely take care of herself better, and interest in her will be maintained as a result.

Stocks sometimes follow a similar path.

Beware the Flash in the Pan

As the phrase states, “one day does not a trend make.” Therefore, it makes sense to make a stock prove itself – at least for a little while – before taking a position.

The single-day spurt higher on news will bring no-name stocks into view on a regular basis, but most of those are just having their 15 minutes of fame. If what you’re seeing is just a knee-jerk response to a headline, there’s limited opportunity and that stock is likely to drift right back into obscurity. Avoid those.

Instead, as a stock begins to earn respect (and attention), watch for the key characteristics that it’s starting to trend: expanding volume, higher highs and higher lows, and a good price/volume relationship. These stocks are much more likely to stick around and offer you multiple opportunities to participate and profit.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

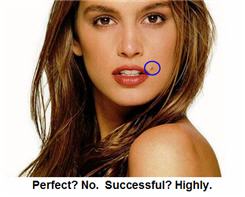

Be Imperfect!

June 24, 2011 at 9:43 am

Society trains us to want to be perfect. And in many endeavors, that’s something worth striving for. Surgeons, for example, can put you at ease when they tell you they’ve performed this operation hundreds of times without any problems. Students with perfect grades get academic scholarships, saving boatloads of tuition money. And the list of examples of the benefits of perfection goes on and on.

Society trains us to want to be perfect. And in many endeavors, that’s something worth striving for. Surgeons, for example, can put you at ease when they tell you they’ve performed this operation hundreds of times without any problems. Students with perfect grades get academic scholarships, saving boatloads of tuition money. And the list of examples of the benefits of perfection goes on and on.

From our appearance to our performance, someone else will always be a little better, and it causes us to try to perfect whatever it is we’re doing for the sake of improvement (or keeping up). Unfortunately, it carries over into our trading – much to our detriment.

You see, when it comes to trading, there’s no room on the perfection list. And that’s a good thing, because perfection isn’t required for success.

The very worst traders try to be perfect. They either stay sidelined in search of a perfect strategy (backtesting galore), or they practice trade until they make $1M in hopes of duplicating it live, or they simply refuse to lose.

Perfection in trading is paralyzing, both to you and your account. Growth is prevented, confidence suffers, and you feed the very traits you should strive to shun.

I’ve said before that in trading, you succeed by not failing. But that doesn’t mean you can’t have failed trades – quite the contrary. Expect losses! As negative as that might sound, it will mentally prepare you to accept them gracefully and move on to the next trade which might be a far bigger winner).

The best traders are imperfect – by choice. They grow from mistakes, not successes. Lose small and face the music when your current approach isn’t working. That shows true confidence. By definition, imperfection brings opportunities for growth – both in your account (lose small and win bigger) and in your abilities as a trader (learn new methods). But you’ll miss out if you’re not willing to bend.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

How Traders Get a Raise

June 22, 2011 at 11:56 am

Every business has overhead (some more than others), and although you may not have a brick-and-mortar storefront, you certainly have overhead as a trader.

Every business has overhead (some more than others), and although you may not have a brick-and-mortar storefront, you certainly have overhead as a trader.

It’s business 101 that to make more money, you either bring in more revenue or you fatten your profit margin by cutting costs. Plenty of posts on this blog discuss ways to accomplish the former, but today, we’ll talk about the fastest way to achieve the latter.

The Elephant in the Room

Traders rarely stop to consider the biggest expense they face, which is usually commission costs. The fees we pay to enter and exit trades are no doubt a cost of doing business, but once you’ve hit a certain experience level with your trading, it’s likely that your attention has diverted to strategy and execution (which is fine). By default, however, you’ve ignored one expense which can easily run into the mid 5 figures over the course of the year if you’re an active trader.

Even if that’s not the case with you, it’s still worth taking note of just how much you’re paying on commissions. Newbie traders recognize this when they come to the market with small accounts, and they soon realize that they’ll need a sizeable move in the stock just to overcome their costs.

Regardless of your situation, take heart! There is a solution…

NEGOTIATE YOUR COMMISSIONS!

Aside from why you should do this, here are a few reasons why you can do this…

Apples to Apples. Transaction costs have come down tremendously in recent years for everyone. Technology has greatly improved, which isn’t cheap, but the fact is that when it comes to the standard trading platform features, virtually everyone has similar technology. Occasionally you’ll find something very unique, but you can most likely accomplish your trading on a variety of platforms, which means you aren’t tied down to any single brokerage. They know this.

Move the Line. Every brokerage has the capability to lower your commissions. So, get creative if you need to. Work the numbers and find out if there’s a threshold you need to meet in terms of monthly trading volume in order to get an improved rate. Find out if they’ll waive your platform fee (if you pay one) at a certain level, or switch from a per-trade to a per-share commission structure.

The Advertised Rate is a Starting Point. The displayed homepage commission price which brokerages show is a number most people will gladly pay, but it doesn’t have to be “the” number. And the more active you are as a trader, the more you should view it as simply a starting point for negotiations. Every brokerage knows their margins, and they know the rock-bottom price which they can offer. I can guarantee you that’s not their advertised rate. They have room to move, and often all it takes is simply knowing you can ask for something a little lower. And while these are certainly not used-car salesmen, the same principle applies…if they let you walk away, then they really can’t deliver the price you’re asking for.

Competition Abounds. Brokers are highly competitive and motivated to get your account, and they know there’s lots of turnover in the industry. That means they can lure you away from your current firm, but it also means if they don’t retain your business you’ll go elsewhere. So if you’re looking for a new platform to trade on and you’re hunting brokers, ask for a reduced rate. Odds are, if you find it offered elsewhere, you can get that rate matched. And even if you’ve been with your current brokerage for quite a while, there’s no harm in asking for a lower commission rate. Remember, if they don’t keep you, someone else will earn your business, and they don’t want to lose you.

You don’t have to be a smooth talker to pull this off. Call up your broker and ask what they can offer you. Worst case, they tell you no and you’re exactly where you are now. But in many cases, you’ll be able to cut down your transaction costs, which can lead to a big pile of money by the end of the year. How is that not worth asking for?

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Two Ranges to Watch

June 21, 2011 at 11:28 am

Last week we saw an important test of the March lows in the NAZ and RUT, while the S&P 500 held slightly above support from the spring. Those March lows give us a well-defined area to trade against, even if it’s a long way back up to the May highs. Stated otherwise, we may have just carved out the low end of a very wide range.

But that’s not the only range found in this market. We also have the NAZ caught between the 2700 area (late-Feb low & mid-April low) and the 2600 area. It’s working its way back up toward 2700, so the key will be if that level can be reclaimed on a closing basis.

Here’s a look at the NAZ, including both the wide and narrower ranges previously mentioned:

The S&P 500 has a slightly different situation here as it held above the March low and is currently flirting with the 1294 area which has proven important. We saw the late-Feb selloff end at that level, as well as the mid-April pullback finding support at 1294. More recently, that level was broken on June 6 and has yet to be reclaimed on a closing basis. A push back up through there could certainly help this index, although it still has plenty of rebuilding work to do. It has a higher intermediate-term low in place for now (June vs. March), but still stands a considerable distance from prior bounce levels (most notably 1345 from May 31).

Here’s a look at the S&P 500 chart along with the noteworthy levels right now:

Needless to say, this market remains interesting and there should be no shortage of movement going forward.

On another note, the premium newsletter turns 7 today, so for those of you who are members and have stuck around from the beginning in 2004, we appreciate you and remain committed to providing ongoing, exceptional value which adds to your trading process!

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Caught In A Trap

June 16, 2011 at 5:44 am

Anytime the market tanks like it has lately, astute traders realize that shorting after a decline of this magnitude and momentum is a real potential bear trap. A sharp rebound could come at any time, leaving late shorts in a world of hurt.

I can’t and won’t argue with that – in the short term.

But the further this market declines in the intermediate term, the growing group of trapped traders are the bulls. Keep in mind that the past few weeks have been a big shift of character for this market, with the prevailing mantra moving from buy-all-dips to sell-all-rallies. Technically, that’s very important to recognize.

And while a sizeable bounce will eventually arrive, the important issue for most bulls is “from what level?”

Head Games

That brings into play the psychological aspect of this change of character, whereby not only do bulls become fearful, but the bears gain confidence. Bulls who bought virtually anytime over the past few months are now underwater, and the deeper this correction goes, the more that late-to-the-rally-party group wants out.

That could quite easily play out with bulls selling on the way back up – just the opposite of a few weeks ago when trapped bears covered on every little dip. By the same token, just as a few weeks ago we were still seeing underinvested or aggressive bulls put more cash to work on even minor pullbacks, the deeper this correction goes, the more the bears will be using bounces to remount short positions. That means what used to be buying by both camps is quickly morphing into selling by both camps.

A spring back up will at some point arrive, so fear not – this market is still a 2-way street. But for now, respect for the tape should remain very high, because anything is still possible. Whenever the inevitable recoil of this selloff kicks in, keep in mind that it too could get faded, and therefore will have to earn your trust.

Here’s a look at the S&P right now with the March lows coming quickly into view at 1249 (which may need to get broken before a real bounce happens):

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast