All Entries in the "Tools of the Trade" Category

All Entries in the "Tools of the Trade" Category

Let Your Trades Go

August 4, 2011 at 7:15 am

Trading on certain timeframes requires that we monitor every tick, gauge the momentum, and continually modify our management of the trade.

For most traders, however, more of a hands-off approach is far better. Whether it’s a job that prevents fixating on the screens, or simply an aversion to that high a level of activity, many traders choose to operate on a timeframe that doesn’t require their nonstop full attention.

When I’m swing trading, there’s a tool I utilize that makes all the difference in the world. It allows me to take a set-it-and-forget-it approach to my trades so I can set them up and let them go. It helps me prevent interfering with my positions so that my original trade plan can fully develop.

Just as you should, I already know from the outset of my trade what I’ll risk if I’m wrong and where I’ll ring the register if my target is reached, so with those pieces of the equation already known, all I need to do is plug them in.

Read this post for an explanation and a video I made explaining how I trade with Peace of Mind.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Charting App for Android – Finally!

March 11, 2011 at 12:31 pm

I became a smartphone user back in 2004, and for all this time I’ve waited for a charting app that was suitable for me. I’ve long been able to manage positions and place trades from my phone, but what’s been lacking has been a customizable, high-quality, dedicated charting app – until now.

I became a smartphone user back in 2004, and for all this time I’ve waited for a charting app that was suitable for me. I’ve long been able to manage positions and place trades from my phone, but what’s been lacking has been a customizable, high-quality, dedicated charting app – until now.

Worden has delivered excellent charting products for decades (I’ve been a Worden user since the 90’s), and now they have a charting app in the Android Market (iPhone app coming soon), TC2000 Mobile.

I downloaded it today, and it instantly exceeded my hopes for what it might do. I had expected to be able to punch in symbols and pull up a chart or customize the look of the chart or timeframe, but was blown away when I realized it has all of MY watchlists from TC already in there – AND all my chart templates!

A few of my favorite features:

- View your personal WatchLists in real-time

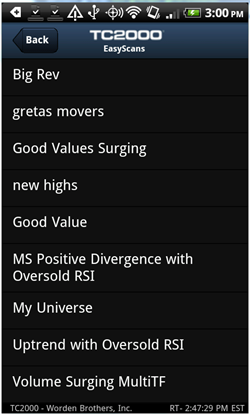

- Run your EasyScans with your custom settings on the go

- “Spacebar” through your WatchList charts by swiping right & left

- Read the evening Worden Reports

The newest version of TC2000 is a go-anywhere, access anywhere (desktop, browser, and now mobile app) version that’s getting better every week with added features and regular improvements. It’s just coming out of beta, and I’m thoroughly impressed with what it already offers.

Screenshots of the new TC2000 Mobile charting app:

The TC2000 Mobile charting app is available through Gold or Platinum service levels, so if you’re one of the many thousands of TC2000 users with an Android phone (or soon on the iPhone), this is a must-have trader app!

**Update: iPhone app now available in app store.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

Peace of Mind With Bracket Orders

August 12, 2009 at 9:54 am

Trading is stressful enough on it’s own, and all of us can at times have outside distractions which pull our attention away from the trading screens. Whether it’s a work project, a trip to the doctor, travel plans or tax season, there can be a constant flow of interruptions to your trading.

Some of them can mean actual losses while others mean missed opportunity, but the bottom line is that that’s life and we have to find ways to get around them if we want to push ahead with our trading.

Enter the Bracket Order

I’ve been using these with thinkorswim for some time now, and I’ve really been pleased. Their platform has a ton of features for options traders, but they didn’t neglect those of us who trade stocks.

I particularly like the bracket order capabilities, and I use the ‘1st Triggers OCO’ all the time in my swing trading. It’s nice to be able to set up a trade when you know your entry, stop and target, and be able to trust that it is being taken care of so that you don’t have to watch it. That allows me to spend my time seeking out new trades rather than managing existing positions.

These conditional orders are pretty amazing, and they’ve gotten sophisticated enough that they can accomplish pretty much whatever you want done at whatever time you want it. What originated as a simple alert has evolved into a multi-faceted tool which many of us will never again trade without.

Traditional order types are available everywhere, and if used properly can sure help you implement your trading plan better than you could without them.

But why ride the bus if you can be chauffeured around in a limo?

Using old-school order types like a stop buy order can certainly help you catch an entry on that trade you’ve been stalking, but won’t you need to protect your capital with a stop loss order rather quickly after your order is filled? What happens when that busy life of yours prevents you from being at the PC when it’s time to put in that safety net? You’re up a creek without a paddle.

If you could structure your entire trade in one order, wouldn’t you do it? If you know the price at which you’ll enter a trade, stop out, and take profits, then let technology help you. I can’t think of an excuse good enough to avoid using these orders, because they truly are the best thing out there.

How it Really Works

I’ve been using this functionality in the form of ThinkOrSwim’s “1st Triggers OCO” orders, so let me explain. The “1st” portion is my entry order, such as ‘buy XYZ @ $25.” The ‘Triggers OCO’ portion means that once I am filled on my XYZ purchase, a One-Cancels-Other order is immediately and automatically placed.

This latter portion is actually a pair of orders which the system will manage for me. If I set a limit sell at a higher price for taking profits, and a stop loss down below as my safety net, then I’ve structured my XYZ trade in such a way that I know my risk and my potential reward. Because I only want to sell my shares once but yet have two sell orders, the system will automatically cancel the remaining order once the first one is filled. So if XYZ climbs to my target and I sell for a gain, my stop loss order is canceled. If on the other hand XYZ were to fall to my stop level before reaching my profit target, the system will execute my stop and cancel my remaining (unfilled) limit order since I no longer own shares to sell. Pretty sweet!

Here’s a video explaining it. Select the HD option and go full-screen for best quality:

Bracket orders are excellent tools which offer the trader a ton of flexibility (there are many more of these advanced order types), but in my opinion the best thing they offer is peace of mind.

There’s just something about knowing that your plans for a trade will be carried out whether you’re at the PC or not. That gives me the freedom to put my trading ideas into motion, knowing full well that I will be able to book profits where I see fit and yet limit my losses in case I am wrong (barring an adverse price gap in the stock of course).

If you’re not using conditional orders in your trading, you should be! They can quickly become a part of your daily routine, giving you the ability to trade to your heart’s content without letting life’s distractions interfere with your plans!

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

How I Maintain Multiple Watch Lists

June 18, 2009 at 7:21 pm

I’ve been known to periodically emphasize the importance of watch list management and maintaining quality watch lists, but it’s time I show you exactly how to go about doing that. This is absolutely essential to staying sharp as a trader, because it avoids one of the primary pitfalls of today’s trader – indecision.

Perhaps you’ve been there before. The market shifts from not doing anything to suddenly gaining momentum, leaving you with zero positions on. Quickly, the fear suddenly strikes you that you’re getting left behind.

Yes, the summertime can be known for that, but it can happen anytime. And it’s quite irritating to get caught feeling flat footed when the market bolts.

My Solution

I kept feeling like I needed a way to manage my favorite setups, but I didn’t quite know the best way to accomplish it. I’ve maintained bullish and bearish watch lists for years, but they were always separated and it was tedious to add and remove stocks to the respective list.

If you’re anything like me, “tedious” diminishes the likelihood of that getting done regularly, because let’s face it – we’re all pressed for time these days.

Well, thanks to the folks at Worden who made this possible, StockFinder’s Flag Column feature provided the perfect solution. I set up multiple flag columns tied to new watch lists, and I’ve been absolutely thrilled at what it’s done for me.

With ease, I can now add and subtract stocks from various watch lists with a quick double-click, which means there’s virtually no time involved, and more importantly, I am staying organized.

When the market moves now, I have a go-to list of names for the appropriate scenario that I can immediately turn my attention to. It’s made a HUGE difference in my decision-making, and it didn’t require that I turn into a super-organized person (that probably wasn’t going to happen!).

Show & Tell

Instead of writing a 2000 word essay on how to do this, I’ve created a quick tutorial to show you how to build a layout exactly like I use. I posted this same clip over on the Trading Videos site and perhaps you’ve seen it there, but in case you didn’t, I wanted to put it here on the blog.

Let me highly suggest viewing the HD version and going full-screen. You’ll want to see the detail.

Oh and if you aren’t already using this software, you can give it a try for 30 days free. I use it every day and can’t imagine trading without it, so I can’t endorse it highly enough.

Here’s the link to download the 30 day trial – I’m guessing you’ll keep it like I did!

Thanks for stopping by and I’ll see you here soon with more. Until then…

Trade Like a Bandit!

Jeff White

President, The Stock Bandit, Inc.

Swing Trading & Day Trading Service

www.TheStockBandit.com

[tags]Stock Market, Day Trading, Stock Trading, Investing, Swing Trading[/tags]

7 Trading Lessons from the Masters

April 13, 2009 at 1:58 pm

As a trader who loves my job, I find it difficult to witness any big event without looking for some parallels to trading. The sports arena is one of those places, and it doesn’t take much of a stretch of the imagination to recognize frequent lessons that are applicable to trading.

As a trader who loves my job, I find it difficult to witness any big event without looking for some parallels to trading. The sports arena is one of those places, and it doesn’t take much of a stretch of the imagination to recognize frequent lessons that are applicable to trading.

Just about anytime someone’s talent or emotions are being tested, you’re likely to also gain some insights which can help your trading.

This past weekend in watching the Masters tournament, I couldn’t help but notice a few things about some of the players. Here are some of the things which caught my attention and the corresponding lessons…

1. Some days you don’t have your best game, but grind it out anyway. Tiger was a little off all week. He verbally discussed it, but it was also easy to see if you’ve watched him at all when he’s at his best. But in spite of not having his “A” game, he chose to grind on every shot and concentrate as much as possible. He came up a little short, but he had a chance on the back 9 on Sunday – which he admits is all he ever wants. What if you’ve done the same all week with your trading by the time Friday afternoon rolls around – do you think you’d be satisfied?

2. Stick with your style and be confident in your approach. Jim Furyk isn’t a long hitter compared to the guys he’s competing against, so he of all people is not going to overpower Augusta National. He had to lay up on some of the par 5’s, but he kept to his strategy and it put him into the mix with a chance to win come Sunday. Waiting for your setups to come along as a trader means not attempting unfamiliar approaches or those which don’t work for you. Trust your method!

3. When you’re hot, ride it – and enjoy the moment. Anthony Kim at age 23 is just one year older than Nick Adenhart, the Angels pitcher who died tragically last week. Recognizing the similarities of not only their ages but careers as professional athletes, Kim was touched by Adenhart’s death. Thinking of how brief life can be, Kim decided to enjoy himself and put life into perspective. After reading about Adenhart on Friday, Kim went out to set a Masters record by making 11 birdies in a round. He got out of his own way and allowed his talent to take over. When you’re reading the market well and your trading is on track, trade a little bigger and see what happens. It’s only trading.

4. Take your lumps with maturity. During the second round on the 15th green, Padraig Harrington addressed a short birdie putt when a gust of wind moved the ball. In accordance with the rules, he replaced the ball to its original position with a 1-stroke penalty, and made his par putt. Having won the previous 2 major championships and having been in good shape on the leaderboard Friday, Harrington would have had plenty of reason to be upset or shaken. But he went on about his business, not allowing a bad break to rattle him. When a good trade suddenly reverses on you or unexpected news costs you money, accept it like a mature trader. Keep plugging away with unflappable confidence.

5. Embrace opportunities with confidence. Kenny Perry has been close before in a major, having been beaten in ’96 in a playoff during the PGA at Valhalla in his home state. He’s won a number of times on the PGA Tour, and worked himself into the lead during the Masters. Success would have meant he’d become the oldest winner of a major championship, as well as his first major win. Facing the opportunity which Sunday brought along, Perry knew he’d either succeed or fail. And he relished the chance to walk that fine line. Trading afraid or scared won’t bring the success you crave. View every chance as an opportunity to build greatness, and face it head-on.

6. A little bit of nerves are good. Chad Campbell found himself right in the mix all week as he searched for his first major victory. When asked by the press about his nerves being on such a big stage and facing such a huge opportunity, he openly admitted that he had been and would be nervous. He also noted that having some nerves are a good thing, that they show you’re intense enough to care. When you find yourself nervous over trades, is it because it matters to you or is it because you’re afraid?

7. Don’t let a poor start steer your day. Angel Cabrera struggled early on Sunday as he found himself playing in the final group. At 1-over par through 5 holes, he was playing worse than everyone else on the leaderboard, losing ground and clearly uncomfortable. But he settled himself down and played solid for the remainder of the day, finishing with 3 birdies in his last 6 holes to get into a playoff – which he eventually won. Allowing your first few trades of the day or the week to define you isn’t the best course of action. Even if your year is off to a poor start, you can still salvage success. Stick with your game plan and trust that your experience and effort will pay off. Your attitude is a weapon – either you hurt yourself with it or you use it to your advantage.

I hope your trading week is a great one!

Jeff White

President, The Stock Bandit, Inc.

Swing Trading & Day Trading Service

www.TheStockBandit.com

[tags]Stock Market, Day Trading, Stock Trading, Investing, Swing Trading[/tags]

TheStockBandit University Has Launched!

March 12, 2009 at 9:14 am

There is a lot to be thankful for right now if you’re a trader. But if you’ve been part of the buy-and-hope crowd throughout the past 16 months, it’s been a tough ride – and might not be over yet.

Ignoring account statements sure isn’t the most responsible way to react right now, and yet it’s probably incredibly common. Those familiar with that mentality are quite likely rethinking their approach, especially given the fact that the S&P 500 has actually lost 40% over the past decade.

Index funds, schmindex funds.

As a trader for the past 11 years, I’ve come to appreciate the flexibility that trading offers. I wasn’t full-time initially, and yet I still recognized the aspect of defense which trading offers – a luxury that the buy-and-hope crowd knows nothing about.

During that time, I’ve run across many people who know a little about “the market” but very little about trading. Things like hardware, software, lingo, order types, psychology, money management and much more are just not the kinds of things that automatic investment plan types are familiar with. So when the market takes an all-out beating like it has since the 2007 top, many in the longer-term crowd would consider becoming short-term but simply don’t know how.

Learning About Trading

All along, I’ve been providing a premium service for those who are swing trading and day trading, but those who don’t understand trading to begin with are not going to benefit from it. They need a trading education.

There’s a huge information gap between investors and traders, so I set out to bridge that gap with the creation of TheStockBandit University.

TheStockBandit University is a 4-week course set up in an on-demand video format to teach those with the desire to learn about trading.

To clarify…

This is not a what-to-trade course.

This is a course for the aspiring trader seeking some trading education. It is designed to take you from 0 to 60 in the trading realm in just 4 short weeks. It’s there to equip you to start taking control and stop getting shredded in this (or any other) bear market.

Stop by the homepage and check out the intro video for more information on how to learn trading if you fall into that category. Because remember, the idea isn’t to invest but to Trade Like A Bandit!

Jeff White

President, The Stock Bandit, Inc.

Swing Trading & Day Trading Service

www.TheStockBandit.com

[tags]Stock Market, Day Trading, Stock Trading, Investing, Swing Trading[/tags]

What Are You Doing Next Wednesday Night?

July 17, 2008 at 2:32 pm

I am thrilled to have been invited by the fine folks at Worden to help out with a free Blocks webinar next Wednesday, July 23rd at 8pm ET.

I’ll be co-presenting with Worden’s Director of Training, Craig Shipman on Discovering Stocks Suitable for Your Trading. It’ll be 1 hour long, completely free, and we’ll point out a couple of core trading concepts and how to put them into practice with Blocks. I hope you’ll join us!

Specifically, the webinar will cover how to locate stocks which are appropriate for your trading style, as well as how to evaluate pullbacks for potential buys.

Here’s how you can register…

Visit the Worden homepage, and click the Blocks logo at the top of the page:

Then click the Upcoming Webinars description beside the July 23rd event:

Sure hope to see you there Wednesday! It should be a fun, action-packed hour with some very helpful hints & tricks on using Blocks to find potential trading candidates.

And of course, if you aren’t already using this charting software, then you’ll see what you’re missing out on. I’ve discussed this revolutionary product before, and it just keeps getting better.

(PS. Those who register will have access to the archived webinar even if you can’t attend live.)

Jeff White

President, The Stock Bandit, Inc.

Swing Trading & Day Trading Service

www.TheStockBandit.com