All Entries in the "Trading Psychology" Category

All Entries in the "Trading Psychology" Category

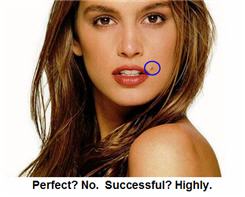

Be Imperfect!

June 24, 2011 at 9:43 am

Society trains us to want to be perfect. And in many endeavors, that’s something worth striving for. Surgeons, for example, can put you at ease when they tell you they’ve performed this operation hundreds of times without any problems. Students with perfect grades get academic scholarships, saving boatloads of tuition money. And the list of examples of the benefits of perfection goes on and on.

Society trains us to want to be perfect. And in many endeavors, that’s something worth striving for. Surgeons, for example, can put you at ease when they tell you they’ve performed this operation hundreds of times without any problems. Students with perfect grades get academic scholarships, saving boatloads of tuition money. And the list of examples of the benefits of perfection goes on and on.

From our appearance to our performance, someone else will always be a little better, and it causes us to try to perfect whatever it is we’re doing for the sake of improvement (or keeping up). Unfortunately, it carries over into our trading – much to our detriment.

You see, when it comes to trading, there’s no room on the perfection list. And that’s a good thing, because perfection isn’t required for success.

The very worst traders try to be perfect. They either stay sidelined in search of a perfect strategy (backtesting galore), or they practice trade until they make $1M in hopes of duplicating it live, or they simply refuse to lose.

Perfection in trading is paralyzing, both to you and your account. Growth is prevented, confidence suffers, and you feed the very traits you should strive to shun.

I’ve said before that in trading, you succeed by not failing. But that doesn’t mean you can’t have failed trades – quite the contrary. Expect losses! As negative as that might sound, it will mentally prepare you to accept them gracefully and move on to the next trade which might be a far bigger winner).

The best traders are imperfect – by choice. They grow from mistakes, not successes. Lose small and face the music when your current approach isn’t working. That shows true confidence. By definition, imperfection brings opportunities for growth – both in your account (lose small and win bigger) and in your abilities as a trader (learn new methods). But you’ll miss out if you’re not willing to bend.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Caught In A Trap

June 16, 2011 at 5:44 am

Anytime the market tanks like it has lately, astute traders realize that shorting after a decline of this magnitude and momentum is a real potential bear trap. A sharp rebound could come at any time, leaving late shorts in a world of hurt.

I can’t and won’t argue with that – in the short term.

But the further this market declines in the intermediate term, the growing group of trapped traders are the bulls. Keep in mind that the past few weeks have been a big shift of character for this market, with the prevailing mantra moving from buy-all-dips to sell-all-rallies. Technically, that’s very important to recognize.

And while a sizeable bounce will eventually arrive, the important issue for most bulls is “from what level?”

Head Games

That brings into play the psychological aspect of this change of character, whereby not only do bulls become fearful, but the bears gain confidence. Bulls who bought virtually anytime over the past few months are now underwater, and the deeper this correction goes, the more that late-to-the-rally-party group wants out.

That could quite easily play out with bulls selling on the way back up – just the opposite of a few weeks ago when trapped bears covered on every little dip. By the same token, just as a few weeks ago we were still seeing underinvested or aggressive bulls put more cash to work on even minor pullbacks, the deeper this correction goes, the more the bears will be using bounces to remount short positions. That means what used to be buying by both camps is quickly morphing into selling by both camps.

A spring back up will at some point arrive, so fear not – this market is still a 2-way street. But for now, respect for the tape should remain very high, because anything is still possible. Whenever the inevitable recoil of this selloff kicks in, keep in mind that it too could get faded, and therefore will have to earn your trust.

Here’s a look at the S&P right now with the March lows coming quickly into view at 1249 (which may need to get broken before a real bounce happens):

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are You Willing to Lose, Part 2

June 2, 2011 at 10:27 am

Yesterday in Part 1, we discussed the idea that while losing is a part of trading, it still must be done the right way. We also talked about how a fear of losing can characterize our trading if we allow it, much to our detriment if left unchecked. However, as Mark Ritchie’s comment emphasized, a willingness to lose is fundamental to turning a profit.

I'm not a cat fan, but this one has guts!

The ‘food for thought’ question I left you with was along the lines of “what characterizes your trading approach: fear or confidence?” Hopefully that’s a question you’re willing to honestly answer, so let’s move forward.

The best traders don’t allow their fear to dictate their success. Yes, they walk the line well. They respect the market and they keep risk in consideration, but they’re confident enough to act when their signal comes along and they move with conviction. They put in the work, identify their plays, and stick to those which are suitable for them. They know what they can lose, and then they go for it.

So, how do you get to that level?

Take Good Trades

Simple enough, right? But I should explain…

To take good trades doesn’t mean take ‘winning’ trades, because of course you can’t know (unfortunately) how they’ll turn out ahead of time. A crystal ball isn’t needed. What it means is take the trades which suit you, which are within the confines of your trading plan. If you don’t have a plan, stop reading this and go make one (anything is better than nothing). You can’t throw caution to the wind or lower your standards, but if all else is in line, then hit the good trades without hesitation over losses. If you’ve defined your risk and have a safety net in place, then be willing to deploy that capital.

Change With Care

Periodically, we all desire some sort of change. Out of impatience, we too often approach those situations the wrong way, and we should be careful.

For example, the trader who casts his fear aside and is willing to lose must still approach his trading the right way. For those aiming higher, a desire to make more needs to outweigh a worry of losing more, yes, but too many approach this adjustment from the wrong standpoint.

In his book, One Good Trade, Mike Bellafiore discusses the trader who wants to learn to make $5k by first losing $5k. Going out and losing $5k doesn’t mean you’re now prepared to make $5k, so don’t prove your willingness to lose by rushing out and widening your max loss – that’s not a solution to anything but taking bigger rips to your account.

Being willing to lose is about showing up prepared to trade confidently and responsibly, not recklessly.

Watch the Right Numbers

Trading is about two sets of numbers: the prices on your screens, and your P&L. Too many traders place their primary focus on the wrong numbers (P&L), and give their leftover, secondary attention to prices.

And they pay for it, too.

Some simply hide their P&L numbers, either for their account or for open positions in order to prevent giving their attention to the wrong numbers. Your job is to stay focused on the game, not the scoreboard!

The condition of your P&L will have some influence, yes, but make sure you’re not trading solely in response to it. Doing so will lead to costly mistakes, such as trying to go bigger when you’re struggling in an attempt to make it back. Instead, focus on the price action for clues – it will tell you what you most need to know.

Here’s the bottom line:

We all know we must accept risk in the markets in order to play and profit, but how willing are you to lose? It’s a question only you can answer, and for too many, their unwillingness to lose will ironically leave them either sidelined in fear, or fully-involved as a stuck holder in a position they should have long since closed. If you’re going to play this game, get your head right and show up ready to play – win or lose.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are You Willing to Lose, Part 1

June 1, 2011 at 11:26 am

In Jack Schwager’s classic The New Market Wizards, Mark Ritchie delivers a very simple but profound statement on the subject of losing:

In Jack Schwager’s classic The New Market Wizards, Mark Ritchie delivers a very simple but profound statement on the subject of losing:

“…I don’t think you can make money unless you’re willing to lose it…my willingness to lose is fundamental to my ability to make money in the markets.”

Losing is a part of trading, there’s no getting around it and everyone does it…but not the same way. The best traders lose like a winner.

Too many traders fear losing, and to be honest I’m often guilty of it too. Sometimes it’s a healthy fear and at other times a limiting fear, so it’s an ongoing issue each of us face.

The wrong kind of fear keeps us on our heels. It might cause us to dart out of good trades too quickly, cutting the legs off our winning trades (get it, so they can’t run?). Or it may leave us sidelined, unwilling to participate even when we sense the presence of opportunity. Sometimes we respond to our fear by trading too small, or simply by becoming far too stressed over trades which are small enough to be insignificant.

For example, you know that when you’re trading small enough that a trade’s outcome (win or lose) will result in virtually no change in your account value, and yet you’re fretting over it, it’s a clear signal that your fear is too great and you’re in no shape to be trading until you get a handle on it. I can say that because I’m familiar with the feeling!

Your Trading, Defined

The title of this post isn’t “Do You Want to Lose?” It’s “Are You Willing to Lose?” There’s a big difference, so let me be clear. This isn’t an approach where we face the markets each day hoping to shrink our account. Rather, it’s a mindset whereby we play only with that which we’re able to lose, and nothing more. It’s a mentality where we trade in such a way that we evaluate our risk, do our best to contain it, and then move forward boldly. We aren’t held back by worry over what might happen.

Tomorrow we’ll wrap this up with Part 2, but until then, let me give you a question to consider:

How would you characterize your own approach…are you defined more by your confidence or by your anxiety?

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Practice Winning

May 31, 2011 at 9:57 am

In my office hanging on the wall, I have a whiteboard, a plasma TV, some handwritten wisdom my grandfather penned in 1973, artwork from my 3-year old, and a Kenny Rogers poster. A bit random, yes.

Right alongside those things, however, is a large photo of Ben Hogan’s 1-iron approach to the 18th green in the final round of the 1950 U.S. Open at Merion. It set up a 2-putt par to put Hogan in a playoff the following day, which he won for his fourth major title. It’s black and white – which is classic – just like the moment it captures.

Preparation + Confidence = Performance

When I stare at the photo, I’m most impressed by Hogan’s focus. Perhaps the first thing you notice about this famous picture is the gallery lining the entire scene. Thousands had spent their day following him, and with the finish imminent, they stood silent, awaiting the outcome. And with history on the line, Hogan hit a masterful shot – just as he had practiced countless times – as if he weren’t nervous.

But he was human – and nervous indeed. He knew what was on the line. His confidence and preparation simply suppressed the effects of his nerves, so that he could perform his craft and execute with precision the same shot he’d hit many times in solitude.

It didn’t matter that he had to make par. It didn’t matter that he had to hit arguably the hardest shot in golf – fading a 1-iron against a right-to-left wind so the ball would land softer on crusty U.S. Open greens. And it didn’t matter that he was likely exhausted from walking 72 holes on legs which had been battered so badly in a near-fatal car accident just a year prior.

What mattered to Hogan was wrapping himself up in the process, ignoring the buzz around him, forgetting (if not thriving on) the pressure he faced, and relying on his preparation – both physical and mental – in order to produce a great result with controlled emotion.

Repetition is the Mother of Skill

Whether it’s sports or music or any other craft – including trading – there’s no substitute for preparation and practice. Hitting golf balls on the driving range can produce the “muscle memory” needed to groove a golf swing. Standing in the gym and shooting free throws every day will make you better. Watching the order flow, working the charts, and making trades on a regular basis will both train your eye and develop the gut feel you need as a trader. And such things must be done by those who want to get good.

But for those who want to be great, that’s not where it stops.

Both your skills and your mental game must be improved.

When it comes to skills, you have to hone your existing skills and tighten up any loose ends. Tighten your routine, and increase your discipline with what you know. But you must also build your cache of talents. Learn to operate on other timeframes. Get better at evaluating risk, managing money, and overcoming biases. Become more efficient by learning when to add to winning trades, hop on board existing trends, identify reversals, trade news, and execute with precision. Not surprisingly, these are the same skills which are taught in the Advanced Trading Course.

When it comes to skills, you have to hone your existing skills and tighten up any loose ends. Tighten your routine, and increase your discipline with what you know. But you must also build your cache of talents. Learn to operate on other timeframes. Get better at evaluating risk, managing money, and overcoming biases. Become more efficient by learning when to add to winning trades, hop on board existing trends, identify reversals, trade news, and execute with precision. Not surprisingly, these are the same skills which are taught in the Advanced Trading Course.

Beyond those things, your mental game cannot be ignored. Visualizing literally everything and mentally rehearsing situations and emotions is another key component. Hogan practiced for repetition, but he also practiced with purpose, picturing situations where he’d need to pull off a shot under pressure or with potential distractions.

You must do the same. Make the time every day to take a break and shut everything down around you. Make a list for yourself of situations you might face in your trading, whether a string of losses or wins, or monitoring multiple positions, or the urge to trade when nothing is setting up, or feeling left behind in a market move. Take them one at a time, and imagine what you will do and how you’ll respond.

Picture yourself in control, not in a way that everything does what you want, but in such a way that you’re not feeling panic or fear or distraction from your trading process. Imagine the intensity of each situation having the opposite effect by actually increasing your focus. Starting off, it may just be a couple of minutes, but as you practice and become more skilled at visualizing, you will add more time. And you’ll be amazed what follows.

As you think about your trading, are you able to approach big situations with supreme confidence? Do you need to know more or improve your techniques or get better equipment or become mentally tougher? Then what are you waiting for?

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Walk the Line

May 27, 2011 at 10:41 am

Trading is all about opportunities. Every day is filled with chances to ride a rally, short a selloff, or sit on the sidelines to protect your capital.

Trading is all about opportunities. Every day is filled with chances to ride a rally, short a selloff, or sit on the sidelines to protect your capital.

But there’s a very fine line to walk between having a fear or respect for what the market can take from you, and having the boldness and confidence to take a risk and get paid.

There are several keys to walking that line successfully, such as:

- Having the necessary capital to participate.

- Building and maintaining sufficient skills, methodology, and a game plan that produces consistency.

- Discipline and readiness to move swiftly when it’s time to act.

- The mental restraint not to let your mind race too far ahead.

That last bullet is arguably more important than the others (although each are necessary), so let’s dig a bit deeper into it. When I say don’t let your mind race too far ahead, I’m not referring to the productive foresight of anticipating a move – that’s fine. Rather, I’m referring to thinking habits whereby you’re focused on things which are not a present-tense reality.

These are the thoughts that have you counting on a gain before you’ve actually booked it, or fearfully racing for the exit at the first sign of your trade’s hesitation. They’re destructive and damaging thought patterns, and they aren’t “on the line” we want to be walking.

In your trading, do you allow your mind to get ahead? Are you able to stay objective? It’s an issue of self-control, and it absolutely impacts your trading results.

I’d love to give you a simple 3-step process to entirely eliminate any lack of discipline in your thought process, but the truth is it takes work. It can’t be rushed. Even your thought patterns are based upon habit.

Final word: commit to making some good decisions every day – no matter how small – knowing it’ll keep you right in the sweet spot between respecting the market and confident execution.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Flip Your Fears

May 26, 2011 at 9:17 am

“Look…if you had one shot, or one opportunity … to seize everything you ever wanted in one moment…would you capture it, or just let it slip?”