Choose Your Discomfort

May 19, 2011 at 9:52 am

Trading is not easy.

Trading is not easy.

There…I said it. As if you didn’t already know.

It can be simple, but that’s different. When you’re trading well, it might feel easy, but when the tough stretches arrive again (and they will), you’ll be reminded that it’s hard. As they say, “if it were easy…”

Contrary to what most traders think, the hard part of trading isn’t being right or wrong. Each of us will find ourselves in winning trades and losing trades at times – even random entries can produce (at least temporary) profits. Discomfort is the hard part.

Discomfort in trading can be tied to either profits or losses.

For example…

Our minds seem hardwired to shun (perceived) failure, so some traders struggle in a big way to close out a losing position and instead spend waste time hoping for a turnaround which may or may not ever happen. It’s uncomfortable for them to admit defeat and accept a small loss, so they usually pay big to try and avoid that.

Our minds can also have recency bias, so after a string of losses, it’s tempting to book a winner – no matter how small – just to stop the bleeding and have a taste of success again. It can be uncomfortable to let open profits ride when you’re clearly on the correct side of a trade – what if you give them back?! You need this winner, right? That often leads to booking smaller gains as compared to what you were on track to get paid, and that adds up big over the course of your month, or your year, or your career.

Discomfort can also be tied to our preferred trading timeframe.

Some can’t stand the erratic price action found on the intraday charts, and they tend to respond with late or forced entries when day trading. They get spooked out of good trades, opting instead to focus on the most recent 5-minute bar rather than the overall direction that’s taking place.

Others can’t stand to give a stock an appropriate amount of wiggle room when swing trading, so they choke off what would be a good trade in favor of a stop that’s too tight. Instead of positioning themselves smaller in order to weather the short-term shake-outs, they essentially overtrade by reacting to insignificant moves within the context of a bigger trend. Profits aren’t allowed to pile up, and their skittish approach keeps them frustrated by the big moves they were once a part of but missed out on.

Here’s my point:

Risk involves discomfort, so if you’re constantly avoiding discomfort, you’re avoiding risk – and by definition, risk must be taken in order to profit in the markets. The key is to manage that risk appropriately, which also means managing your discomfort appropriately.

There’s no getting around discomfort in trading. Everyone has it, regardless of directional bias or timeframe preference or the market being traded.

Either you’re uncomfortable with the results you’re getting (e.g. overtrading, not sticking with good trades, staying too long in poor trades), or you’re going to face some discomfort while denying yourself as you stay with a good position. That’s going to include enduring pullbacks, watching some profits evaporate, and being patient while waiting for an acceleration move to occur.

In an instant-gratification society like ours, it’s no wonder most traders fail. Have the courage to choose your discomfort ahead of time, so that by expecting it and mentally rehearsing what you’ll likely face, you’ll in turn be able to respond with good decisions.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

Trade Review: BIDU Breakdown

May 18, 2011 at 11:56 am

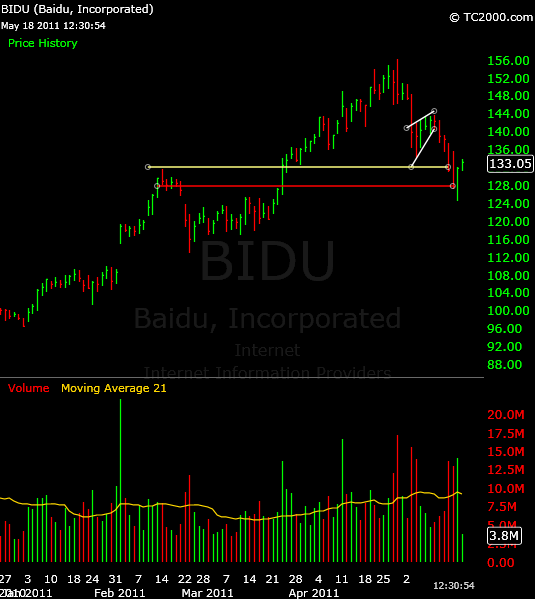

One setup I recently had success with was found in BIDU. Although the money’s been made on this trade, there are still some lessons we can take away, so let’s take a closer look at the trade as it evolved and see what we can learn from it.

The entire Chinese internet stock group had been weakening of late, with names like SOHU, SINA, NTES, and others beginning to struggle. This followed months of leadership, as these stocks made big upside runs by building bases upon bases. The momentum shifted a few weeks ago, and in every case these stocks topped prior to the market’s pullback. (That’s why they call them leaders).

BIDU did the same thing, having peaked in late-April ahead of the major averages like the NASDAQ. Once the overall market began to pull in, these stocks accelerated to the downside, providing further evidence of an important change of character. Having become oversold, they rebounded, but in a lazy fashion. This set up quite a few bearish patterns, with the rising wedge being found in BIDU. I highlighted this pattern for premium readers on the main site, looking to short BIDU upon a break of the lower trend line at $139.50.

BIDU broke that rising trend line, a day after its counterparts NTES & SINA. That offered not only a clean entry for a short sale, but also a stock which had potential to play catch-up on the downside.

I set a pair of targets for booking profits at $132 (yellow line in chart below) and $127.50 (red line on chart below), respectively. Target 1 was reached on day 3 of the breakdown, which was just slightly ahead of the 2/14 high in case it were to be tested. Target 2 was reached on day 4, and that level corresponded with the lower end of the same mid-February congestion zone.

While this stock eventually overshot my $12 per share profit target, it became oversold. Anytime a stock moves too far, too fast, it’s time to watch for a snapback. BIDU has done that in the past 2 sessions, but remains technically damaged. Here’s a current look:

This stock and the others in the group are currently bouncing from their lows, but they remain in a bearish series of lower relative highs on their daily charts. That is to say this bounce may get sold into again, so although this short sale is long since over, we have no evidence yet to support a lasting trend change. Until we do, these are stocks to watch for new short-sided entries to emerge.

A few takeaways:

First, clean patterns are the place to focus. They make it simpler for me to recognize when to be IN a trade, and perhaps most importantly, when to be OUT of the trade. Tighter, more well-defined patterns help me be decisive, and in this game, that’s huge.

Second, stay on top of the sectors. While it’s a bit harder these days to play follow-the-leader when it comes to sector moves, it can still be done with success. Take note of which groups are shaping up for advances or declines, and work the charts for favorable candidates.

Third, when you get your move, ring the register. Greed could have kept me in this trade for a little bigger move, but it also could have kept me in too long, leaving me now to wonder what to do on the current bounce. Blend the info you get by looking left on the chart along with the pattern projection to come up with an exit strategy. Then stick to it!

Fourth, (and this goes hand-in-hand with the previous note), sharper moves are more prone to reversal. When your targets are in sight (or already hit) and the move is getting a bit stretched, expect the rubber band to snap back at least part way. Tighten your stops, book gains, and generally start expecting an imminent exit. Pigs truly do get slaughtered.

Here’s to your next trade, whether a winner or loser, and your commitment to take from it what you can – whether it be profits, a lesson, or both.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

Dealing with the Pop and Drop Trade

May 17, 2011 at 1:43 pm

This question came in from a fellow Bandit recently, and I wanted to share it (and my response back to him) with you here…

Question:

Jeff, what’s the lesson to be learned from this today. One trade I was watching (***) moved past 13.45 in a hurry this morning. By the time a trade could be executed it was already up in the 13.60s, got up as high as 13.74 and then dropped like a rock back down to where it started the day. All of it happened in about an hour. I’m thinking it would have been better to leave this one alone today. Thoughts? B

Answer:

That one did shoot quickly past the trend line, and anytime that’s the case I try to lighten up into the move. The sharper the moves tend to be, the more prone to reversal they are. So while it’s nice to see a big fast favorable move, at the same time it’s imperative to recognize that it may not last long and to use that strength to book some profits.

Another thing I’d add is that anytime you happen to get a bad fill on your order (in this case 13.60 as you mentioned when you wanted 13.45, it’s important to recognize that the risk/reward profile of the trade has just changed. You might have intended to exit around 13.30, or just about 1% from your entry, but a higher-than-intended entry necessitates raising your stop aggressively in order to offset the late buy. Otherwise, your stop is simply too far down and the risk/reward is no longer as favorable as your original plan for the trade.

Another thing I’d add is that anytime you happen to get a bad fill on your order (in this case 13.60 as you mentioned when you wanted 13.45, it’s important to recognize that the risk/reward profile of the trade has just changed. You might have intended to exit around 13.30, or just about 1% from your entry, but a higher-than-intended entry necessitates raising your stop aggressively in order to offset the late buy. Otherwise, your stop is simply too far down and the risk/reward is no longer as favorable as your original plan for the trade.

The idea is to keep managing risk, keep managing risk, keep managing risk when day trading. Sometimes you get ‘slipped’ on an order like that and end up with a later-than-intended entry, so when you do, either keep a tight stop beneath it or trail it behind the trade aggressively so as to either exit with a minimal loss or book a little gain. If the trade doesn’t unfold as planned, look for the next-best alternative, which is getting out about flat or slightly better if possible.

Sometimes as you said, hindsight will show stocks which may have been better left alone, but on the fly we can still manage the situation well with some good habits.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

Archived Webinar

April 20, 2011 at 12:47 pm

Good news! Last night’s webinar in conjunction with Worden was recorded and is now available. If you missed out in real-time, there are still a TON of ideas worth taking note of.

The run time is under 1 hour, and I promise you’ll learn something on top of all the trade ideas presented. Here’s the link to the archived webinar.

Enjoy!

Trade Like A Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

Reminder: Webinar Tonight 8ET!

April 19, 2011 at 10:39 am

Here’s a quick reminder about tonight’s free trading webinar, as I would love to see you there if possible.

Locating Trade Candidates with TheStockBandit

I’m excited to run through a number of interesting chart setups, from both the bullish and bearish sides, in order to teach you some concepts and of course put some quality plays on your radar.

I also plan to share with you a setup that’s been trapping traders lately, which means opportunity for you if approached properly.

The webinar is scheduled to run 45 minutes, with 15 of those minutes set aside at the end for Q&A and a look at your favorite charts.

Visit this link for registration to the 8pm ET webinar:

Locating Trade Candidates with TheStockBandit

See you tonight!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

Webinar: Tuesday, April 19

April 15, 2011 at 2:49 pm

I wanted to be sure to invite you to the webinar I’ll be presenting on Tuesday (April 19th) with the folks from Worden – there’s no charge and I hope you can join us!

Locating Trade Candidates with TheStockBandit

It’s scheduled to be a 45 minute webinar, the first 30 minutes of which I’ll be going through my watch lists, pointing out to you what I’m seeing in the charts for both the overall market and individual stocks.

It’s scheduled to be a 45 minute webinar, the first 30 minutes of which I’ll be going through my watch lists, pointing out to you what I’m seeing in the charts for both the overall market and individual stocks.

There will be 15 minutes of Q&A time at the end where you might want to bring forth your favorite stock and we can take a look at those too.

It’s going to be a chance for me to convey what I’m seeing out there and hopefully not only teach you a few things, but also put many stocks on your radar which you may find of interest.

I’ll also be covering some of the latest developments in how stocks are moving, helping you avoid some of the “obvious” setups which are trapping traders frequently in today’s environment.

Oh, and the best part about it is that this event will be FREE, so be sure to register at this link for details (and access to the recorded version if you can’t attend live):

Locating Trade Candidates with TheStockBandit

Remember: this Tuesday night, 45 minutes of charting reading with you and me – I can’t wait!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

What Are the Leaders Doing?

April 13, 2011 at 11:15 am

The market has been resting for a couple of weeks now – and who could blame it? After a run of more than 7% off the March low, some kind of digestion was in order.

Initially, we just saw indecision as the indexes flip-flopped around key levels (NAZ 2802, S&P 500 1332, DJIA 12400, etc.). Since then, however, they have weakened a bit. That isn’t bad, and the pullback could quite easily result in a higher low on the daily charts (vs. the March lows which are well beneath current levels).

While the broad market grapples with where to go next, perhaps a more pressing issue is what are the leading stocks doing? Let’s take a closer look and see how they’ve fared of late, as well as some key levels to keep an eye on in the days ahead.

The best thing to do right now is allow the market digestion to continue and allow the chart patterns you’re watching to fully mature. Forcing entries out of boredom isn’t the secret, so maintain your discipline and let the market generate signals before you take action. If you choose to play at the wrong times, it’ll cost you. Once somebody else starts the move, then you can hop on board for a ride.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?